Lots of information here concerning politics, elected officials, and elections are on this web page. pima84.info

The Bank Your Vote initiative encourages GOP voters (like YOU!) to get your vote in and make absolutely sure that your voice is heard in the critical 2024 elections. Please consider signing up using this link. BankYourVote.com

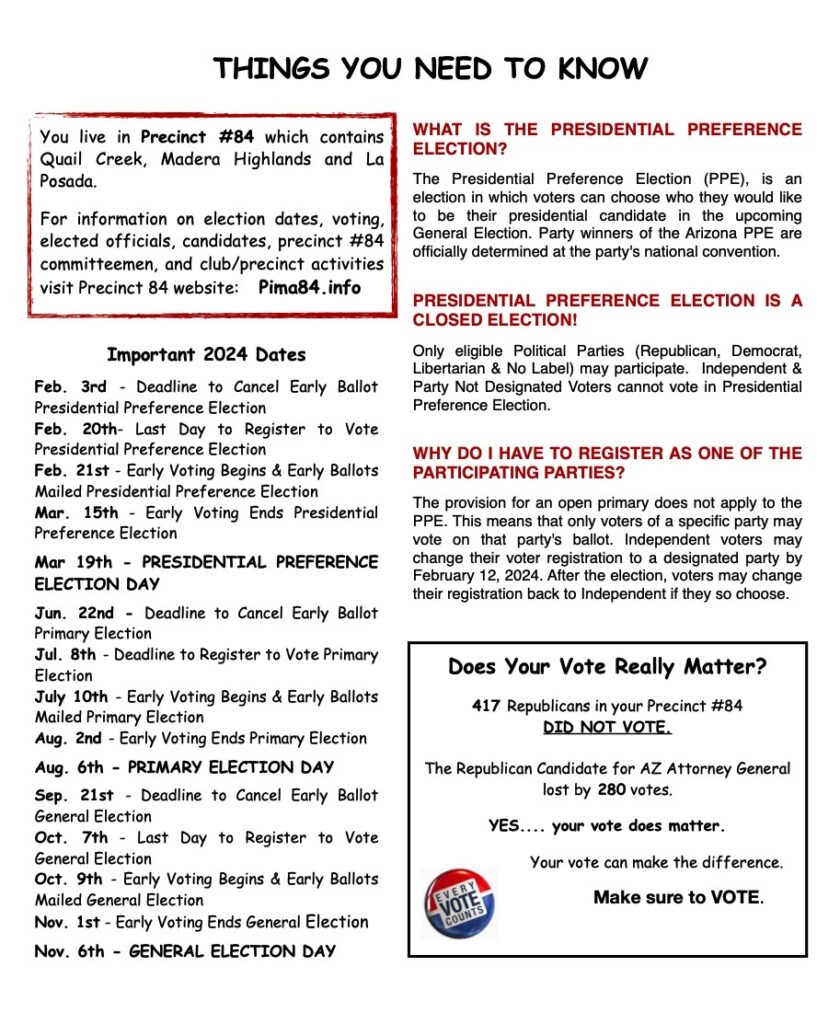

Important information to guide you through the 2024 election cycle.

At the Quail Creek Republican Club meeting on Friday, September 15, Pima County Chief Deputy Treasurer Chris Ackerley, reviewed House Bill 2124 that passed the Arizona state legislature in 2022. This bill had “unintended consequences” that resulted in significant property tax increases for QC homeowners. The attached document briefly explains the problem and outlines actions we can take to address the problem.

Continental Elementary School District

Property Tax Increase

The Problem

In 2022, the Arizona Legislature passed HB 2124, which was intended to revise the funding formula for elementary and middle school districts that do not have high schools. Those districts, of which Continental is one of the largest, previously counted high school students in their enrollment numbers and paid tuition to neighboring districts for their students to attend high schools in those districts. Under the new scheme enacted with HB 2124, property owners in elementary only districts now pay into a fund based on the average cost of a high school student and the district the student attends counts that student in their enrollment numbers. However, HB 2124 did not adequately address how this change would affect other parts of the school funding formula. Most importantly for the Continental School District, which includes all homeowners in Quail Creek, the amount levied for high school students no longer counts towards the minimum tax rate. Under the new formulas, taxpayers in the Continental School District now must now pay the minimum tax rate plus the cost of high school students; essentially paying double what they used to pay in tuition costs for students to attend Sahuarita and Walden Grove High Schools. As a result, your property tax bill for the Continental School primary tax levy has increased by 50% and more!

What you Can and Need to Do About It

Unfortunately, there is nothing you can do to avoid paying this increase on the property tax bill you recently received from Pima County. The only entity that can correct this “unintended consequence” of passing HB 2124 is the Arizona State Legislature which does not convene again until January, 2024. But, it is essential that you write, e-mail, or call the legislators representing Quail Creek, express your anger about this increase and stress the criticality of immediately correcting the problem before 2024 tax bills are released. You might even add that the 2023 tax increase caused by HB 2124 should be refunded to all taxpayers. Make your communication personal. Let them know how much your Continental tax went up. Your legislators representing Quail Creek are:

Rep. Gail Griffin

Arizona House of Representatives

602-926-5895

https://azleg.gov/emailazleg/?legislatorId=2164

Rep. Lupe Diaz

Arizona House Representatives

https://azleg.gov/emailazleg/?legislatorId=2159

602-926-4852

Sen. David Gowan

Arizona State Senate

https://www.azleg.gov/emailazleg/?legislatorId=2127602-926-5154